Home › Forums › Windstone Editions › General Windstone › 2019 New taxes to some states

- This topic has 19 replies, 6 voices, and was last updated 5 years, 3 months ago by GardenNinja.

-

AuthorPosts

-

January 2, 2019 at 6:08 pm #1551085

Hey!

Just a heads up so you guys aren’t surprised like me or maybe some of you already knew 😊 I hadn’t kept up on the ruling of the Wayfair case and taxes.According to eBay: “There are no opt-outs for selling items into [Oklahoma, Pennsylvania, or Washington], or out of eBay automatically collecting sales tax for items shipped to [those states].”

Don’t they tax us all enough already 😑

January 2, 2019 at 6:21 pm #1551089Also, I looked at another purchase from yesterday that didn’t look like it charged sales tax for me in Washington and ebay took the tax after the purchase from my PayPal.

January 2, 2019 at 7:05 pm #1551090This is going to be a headache for a lot of small businesses. I think that it will affect Windstone store sales also.

January 3, 2019 at 3:19 am #1551113Yeah – and if you look at the eBay information (I’ll put a link to it later this morning) there are more States following in July 2019, including California.

I think I’m done selling on eBay unless they reverse this for ‘businesses’ that maybe make something like 10,000 or less in a year? I sell on eBay like a yardsale – some here or there and don’t usually get more than a couple hundred in several months. I don’t need the headache of figuring out taxes. I’d rather go back to yardselling.

OK – Maryland was taxed for ‘rain’ a few years ago – luckily that was overturned. So. When is the Government going to start taxing our air?IN SEARCH OF MY NEXT GRAILS:

Black Peacock & Butternut Adult Poads

Kickstarter 'Rainbow Tiger' Bantam Dragon*~*~*~* Ela_Hara: The DragonKeeper *~*~*~*

*** Come visit me on deviantArt at http://ela-hara.deviantart.comJanuary 3, 2019 at 4:45 am #1551125Hey Guys here is one of the eBay articles about collecting taxes and those States that eBay will collect for. The article lists those States that eBay will collect for sellers on their behalf and the dates effective per State listed. However – some States (could be more than what eBay lists too) have had this law in effect prior to 2019 and perhaps as early as October 1, 2018, when the law was instituted.

‘Happy’ Reading! And I’m sure this is going to stop a lot of occasional eBay sellers, such as myself, from selling on eBay ever again…. :/

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121

Oh – and I just bet that PayPal will be following, if they haven’t started yet, for PayPal ‘Goods and Services’ invoices… unless us ‘Sellers’ need to figure out the taxes and remit them on our own now.

IN SEARCH OF MY NEXT GRAILS:

Black Peacock & Butternut Adult Poads

Kickstarter 'Rainbow Tiger' Bantam Dragon*~*~*~* Ela_Hara: The DragonKeeper *~*~*~*

*** Come visit me on deviantArt at http://ela-hara.deviantart.comJanuary 3, 2019 at 5:02 am #1551127Doesn’t a few states get taxed on air already?😶 What a crock.

Ela_Hara,I am with you on selling on eBay.I am a here and there as need be seller.I agree with if you aren’t a big business,as in China,car lots,etc.,you should be exempt.As dad used to say,”They are nickel and diming us to death.”Every act matters.No matter how small💞

(Wanted......Brimstone Lap)

Male Hearth....one day🤞Dream on.January 3, 2019 at 6:36 am #1551143Honestly, I don’t think this is going to be that big of a deal for most occasional sellers. I have used PayPal to sell to people in the same state as me, and have never worried about it. I think all states with sales tax require you to collect it, but I never have. If your volume is very low, and eBay/PayPal is not automatically charging the buyer the tax & handling everything, I doubt the states are going to try to find you unless your volume is fairly high.

However, I wouldn’t be surprised if many states would consider $10,000/yr to be “fairly high”. I probably make less than $1000/yr selling things.

*You* don’t pay the tax. If you read the details at the link, you are supposed to set up a tax table by state for states eBay doesn’t charge the tax automatically, and eBay will charge the buyer and collect and remit for you.

I hope eBay is working on adding all states that require it to the automatic calculation and collection. They say more states will be added.If they did that, they should have charged the buyer. Check the sale price + shipping versus amount collected. “All” you are losing is PayPal’s 2.9% fee on the sales tax.

My keyboard is broken. I keep pressing "Escape", but I'm still here.

January 3, 2019 at 6:48 am #1551147I always thought sales taxes are based on where the seller is located, not the buyer. That’s why people around me drive to NJ or MA to shop. Heck, that’s why Quebeqois zoom straight through New York and go to NJ to shop. They have lower sales taxes than where I am. According to the link Ela_Hara provided, eBay is going to charge sales tax based on where the buyer is located. Did I understand that correctly?

Looking for...

Sitting young oriental dragon koi gold and white

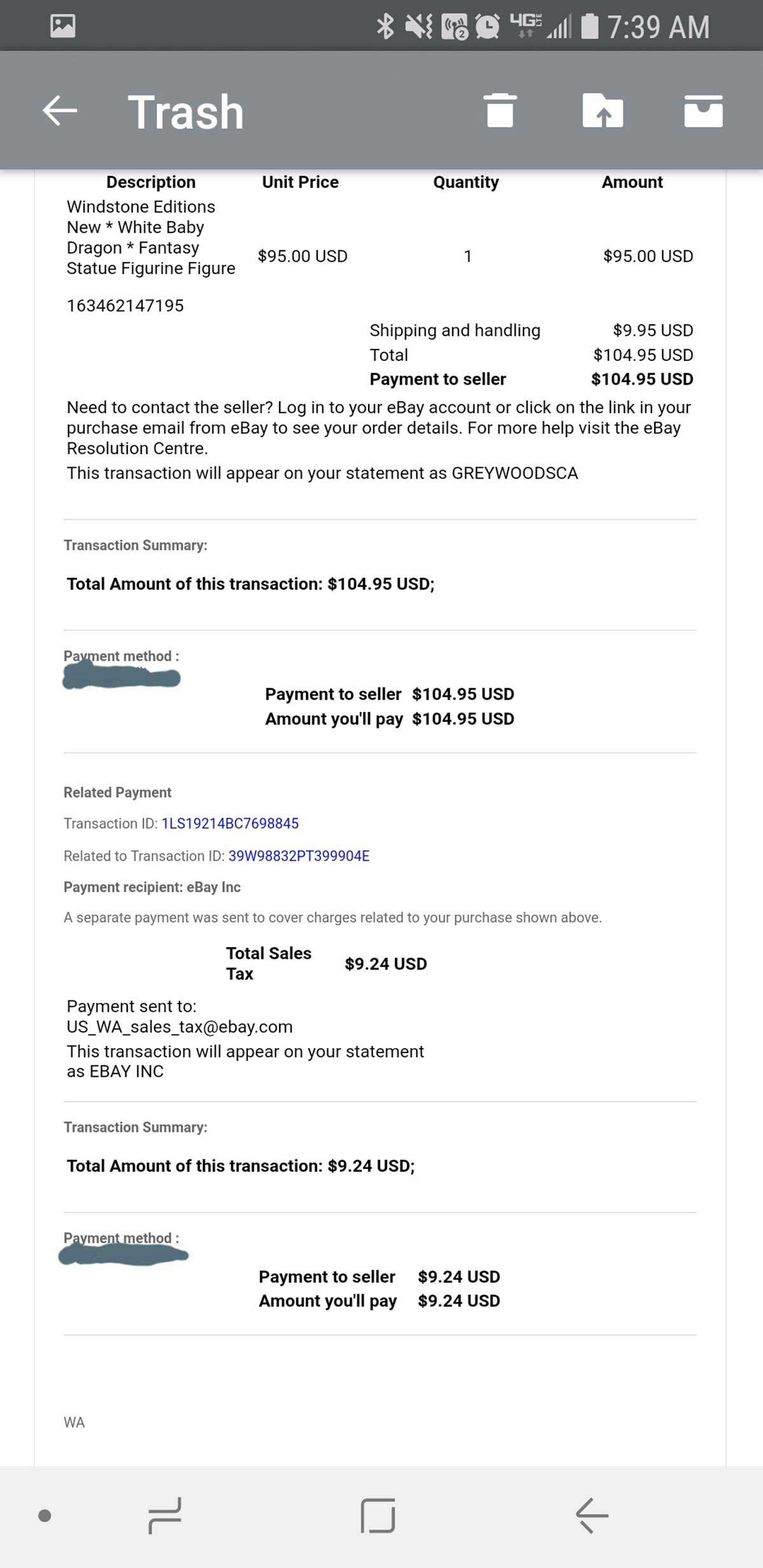

January 3, 2019 at 7:34 am #1551162Also, I looked at another purchase from yesterday that didn’t look like it charged sales tax for me in Washington and ebay took the tax after the purchase from my PayPal.

GardenNinja

If they did that, they should have charged the buyer. Check the sale price + shipping versus amount collected. “All” you are losing is PayPal’s 2.9% fee on the sales tax.[/quote]Tig3r06

I am the buyer. I bought from greywoodscat and she didnt charge tax and ebay took the tax after my purchase. I won an auction from windstone the next day and went to pay and it was charging sales tax up front is how I noticed these changes. Greywoodscat doesn’t seem to sell alot on ebay to me and I got charged tax by ebay on her piece. I have not had anything sell in 2019 on ebay to see if tax is applied automatically to my sales, I’m thinking it will.January 3, 2019 at 7:43 am #1551163January 3, 2019 at 11:11 am #1551182Here is a Washington POST article on it from last summer: https://www.washingtonpost.com/politics/courts_law/supreme-court-rules-that-states-may-require-online-retailers-to-collect-sales-taxes/2018/06/21/a24e0100-755e-11e8-b4b7-308400242c2e_story.html?utm_term=.606148f88e62

Also, an extract from an AP article dated 2 January 2019 and titled “3 things small business owners should know for 2019”:

Now that the new year is here, small business owners may find themselves trying to understand changes brought about by federal and state laws. …

Internet sales tax. The majority of states have enacted laws requiring retailers who sell in their states to collect sales tax even if they have no physical location like a store or distribution within the state. Most of the laws exempt retailers who have $100,000 or less in revenue and 200 or fewer transactions in a given state. Some of the laws are already in effect, while others go into effect during 2019. Some states have not acted yet.

Retailers can use software or services to help them collect tax, submit it to state tax authorities and compile required returns. The software is likely compatible with a retailer’s e-commerce system. Search online for more information,January 3, 2019 at 6:26 pm #1551262Tig3r06 wrote:

Also, I looked at another purchase from yesterday that didn’t look like it charged sales tax for me in Washington and ebay took the tax after the purchase from my PayPal.I am the buyer. I bought from greywoodscat and she didnt charge tax and ebay took the tax after my purchase. I won an auction from windstone the next day and went to pay and it was charging sales tax up front is how I noticed these changes. Greywoodscat doesn’t seem to sell alot on ebay to me and I got charged tax by ebay on her piece. I have not had anything sell in 2019 on ebay to see if tax is applied automatically to my sales, I’m thinking it will.

So – if I understand this correctly….

If I’M the eBay Seller and I’m selling to Tig3r, the buyer who lives in Washington, then I don’t pay taxes and eBay collects the taxes from Tig3r and her account.

And conversely, if I’M the Buyer purchasing an eBay item from Tig3r, a seller who lives in Washington, then eBay will collect the taxes from me and my account.

However, if I sell or buy an eBay item with someone who lives in a State that is not collecting internet retail taxes, then eBay will not collect taxes from either one of us.

Does this sound correct?IN SEARCH OF MY NEXT GRAILS:

Black Peacock & Butternut Adult Poads

Kickstarter 'Rainbow Tiger' Bantam Dragon*~*~*~* Ela_Hara: The DragonKeeper *~*~*~*

*** Come visit me on deviantArt at http://ela-hara.deviantart.comJanuary 3, 2019 at 7:44 pm #1551263Ela_hara That’s how I understand it after reading more. And more states will be added throughout the year in addition to these 3.

January 3, 2019 at 7:49 pm #1551266The first two sound correct. Everything depends on where the buyer lives, not the seller. The transaction is considered to take place where the buyer is. So if you sell to someone in a state that doesn’t collect the tax, then no tax is charged to your buyer. However, if your shipping address’s state collects the tax, then you will be charged the tax on your purchases even if the seller is in a no-tax state.

My keyboard is broken. I keep pressing "Escape", but I'm still here.

January 3, 2019 at 7:54 pm #1551267If people drive to NJ or MA to shop, then they are physically in NJ or MA at the time of purchase.

As for the Quebeqois, the same principle applies, except they are dodging Canada’s duty.My keyboard is broken. I keep pressing "Escape", but I'm still here.

-

AuthorPosts

- You must be logged in to reply to this topic.

Recent Comments